how much is vehicle tax in kentucky

A portion of the fees collected in this transaction includes funds to develop maintain and enhance the states official web portal Kentuckygov. Retail Tax could be 6 of the current average retail listed in the NADA Used Car Guide 6 of the sale price or 90 of the MSRP Manufacturers Suggested Retail Price for new vehicles.

Title Transfer Or Title Registration Global Multi Services Truck Stamps Trucking Companies Service

Motor Vehicle Usage Tax is a tax on the privilege of using a motor vehicle upon the public.

. Once you have the tax rate multiply it with the vehicles purchase price. The non-refundable online renewal service fee is a percentage of the transaction total and is assessed to develop and maintain the Online Kentucky Vehicle Registration Renewal Portal. Sticker shock in 2022 isnt just in store for those shopping for new vehicles or are finding that used vehicles arent as.

It is levied at six percent and shall be paid on every motor vehicle used in. 246 cents per gallon of regular gasoline 216 cents per gallon of diesel. The fee required for Application of Title is 900.

2020 Vehicle Tax Information. 250 for new 1640 for some vehiclescounties. Its fairly simple to calculate provided you know your regions sales tax.

Regional transportation tax in some counties. How much will my car taxes be in KY. In the case of new vehicles the retail price is the total consideration given The consideration is the total of the cash or amount financed and the value of any vehicle traded in or 90 of the manufacturers suggested retail price MSRP including.

Original title from previous state. However ONeill said Kentuckians did not expect an increase as high as 40 60 Don Franklin Sales Manager Stephen Johnson said To put that into dollar value a used car thats 20000 dollars is now worth 27400 David ONeill posted how consumers can protest their assessment of their cars property taxes and value. Dealership employees are more in tune to tax rates than most government officials.

Vehicle use taxMCTD fees NYC and some counties North Carolina. The look-up for vehicle tax paid in 2020 is available at the bottom of the drivekygov homepage. When registering an out-of-state vehicle proof of Commonwealth of Kentucky insurance is required.

Vehicle Tax paid in. Vehicle Property Tax based on value and locality. Vehicle Tax paid in 2020.

Vehicle tax bills to see big jump is 2022. Usage Tax-A six percent 6 motor vehicle usage tax is levied upon the retail price of vehicles transferred in Kentucky. Highway use tax of 3 of vehicle value max.

6 letter it received from the state Department of Revenue advising county clerks who are responsible for collecting. It is levied at 6 percent and shall be paid on every motor vehicle used in Kentucky. D ocuments required.

Payment methods include American Express Discover MasterCard or VISA. Depending on where you live you pay a percentage of the cars assessed value a price set by the state. Kentucky collects a 6 state sales tax rate on the purchase of all vehicles.

The owner of a 2019 Toyota Camry LE paid 20269 in automobile taxes in 2021 based on a NADA trade in value of 16660. Users are instructed to input their VIN and instructions are provided as to where their VIN can be found. Michael Collado is a car buying expert and has been a professional automotive writer since 2009.

Last week the Hopkins County Clerks Office posted on its Facebook page a Jan. Kentucky has a flat income tax rate of 5 a statewide sales tax of 6 and property taxes that average 1257 annually. 2000 x 5 100.

In addition to taxes car purchases in Kentucky may be subject to other fees like registration title and plate fees. On used vehicles the usage tax is 6 of the current average retail as listed in the Used Car Guide or 6 of the total consideration paid. Kentucky Vehicle Sales Tax Fees Calculator February 8 2022.

083 average effective rate. Search tax data by vehicle identification number for the year 2020. Every year Kentucky taxpayers pay the price for driving a car in Kentucky.

Usage Tax A six percent 6 motor vehicle usage tax is levied upon the retail price of vehicles transferred in Kentucky. In addition to taxes car purchases in Kentucky may be subject to other fees like registration title and plate fees. Instead it will come from much higher valuations on vehicles with the 2022 valuations expected to be around 40 higher than they were in 2021.

The taxable value of cars leapt by about 40 between 2021 and 2022 because Kentucky uses national car value estimates to decide how much people will be taxed and used car prices skyrocketed during. Upon first time registration of a vehicle in Kentucky the County Clerk collects a 6 usage tax. Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another.

A motor vehicle usage tax of six percent 6 is levied upon the retail price of vehicles registered for the first time in Kentucky. 6 Kentucky collects a 6 state sales tax rate on the purchase of all vehicles. If you are unsure call any local car dealership and ask for the tax rate.

Payment methods include VISA MasterCard Discover or American Express. Hes written about dealership sales vehicle reviews and comparisons and service and maintenance for over 100 national automotive dealerships. In 2022 the owner will pay 193 a 45 percent increase from the prior year.

Motor Vehicle Usage Tax is a tax on the privilege of using a motor vehicle upon the public highways of the Kentucky and shall be separate and distinct from all other taxes imposed by the Commonwealth. You can find these fees further down on the page. A 200 fee per vehicle will be added to cover mailing costs.

The tax is collected by the county clerk or other officer with whom the vehicle is. A 200 fee per vehicle will be added to cover mailing costs.

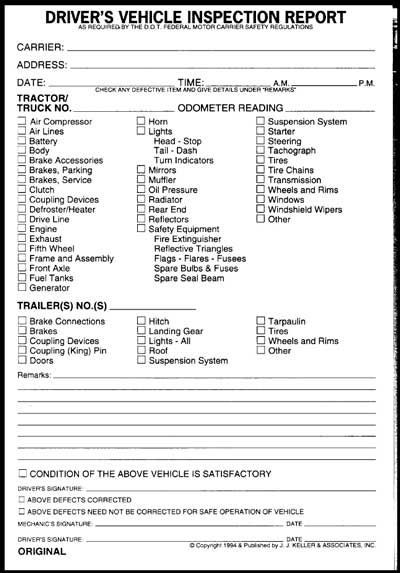

Kentucky Vehicle Inspection Form 15 Things To Avoid In Kentucky Vehicle Inspection Form Vehicle Inspection Vehicle Maintenance Log Inspection Checklist

Pin On Global Multi Services Inc

Global Multi Services Inc Globalmultise10 Twitter Tax Return Us Dot Number Fax Number

Ucr Permits Global Multiservices Tax Return Global Truck Stamps

How To Acquire The Most Excellent And Feasible Used Car Loan From Day Cash Loans Company In Uk Loan Company Car Loans Small Business Funding

Things That You Must Know About Irp Cab Card Correction Registration Paying Taxes Tracking Expenses

Looking For A Small Suv With Great Mpg S Style Bluetooth Connectivity And A Clearance Price Check This One Out Then Come Ford Escape Small Suv Ford Motor

Global Multi Services For Irp New Carrier Renew Tracking Expenses Service